Income Tax Preparer Resume

In case you have already filled the Income Tax Return and it is pending for submission click Resume Filing. Short-term capital gains are taxed at ordinary income tax rates up to 37 the seven marginal tax brackets are 10 12 22 24 32 35 and 37.

Tax Preparer Resume Sample Writing Guide 20 Tips

1 _____ Step 4.

. In case you have already filled the Income Tax Return and it is pending for submission click Resume Filing. Choose the Best Format for Your Tax Accountant Resume. If you are a nonresident alien and your tax withholding rate andor country of legal residence changed during 2021 you will receive.

All other duties that may be assigned from time-to-time by Company management BenefitsBenefits will depend on if hired for Part time Full time or seasonal position. Work for an exempt tax preparer. What is adjusted gross income.

New York has the best-paid financial planners at an average of 166100 per year. Sign the income tax return. Enter the total dollar amount subject to Illinois withholding tax this reporting period including payroll compensation and other amounts.

Include this on your income tax return as tax withheld. Louisiana has the lowest-paid financial planners at an average of. Your FSA ID which you can create on fsaidedgovNote that students and parents will need to create their own FSA ID and keep it private.

On your Dashboard click e-File Income Tax Returns File Income Tax Return. Mid-career Finance Resume Example. Do not sign the income tax return exempt tax preparer is the responsible party No.

Considered one of the most important figures on a tax. This is the total federal income tax withheld from your NSSEB tier 2 benefit VDB and supplemental annuity benefit. Processing Delays for Paper Tax Returns.

The Paid Preparer Due Diligence Training helps you as a tax preparer better understand the earned income tax credit EITC child tax credit CTC additional child tax credit ACTC credit for other dependents ODC American opportunity tax credit AOTC head of household HOH filing status and your responsibilities. Taxpayers should file electronically through their tax preparer tax software provider or IRS Free File. Mid-career Finance Resume Example.

Conducted reconciliation of income statement and balance sheet accounts for newly acquired 10M subsidiary of 40M services company. Then select the AY Mode of Filing Online Resume Filing Step 3. Tax Preparer HR Block Dec 2001 - May 2002 6 months.

Income Properties -Elegant Home Specialist -Evaluating Businesses -MBA Graduate. If you already filed a paper return we will process it in the order we received it. Welcome to the Paid Preparer Due Diligence Training.

Refer to section 44 File Preview and Submit Income Tax Returns to learn. Select Mode of Filing as Online and click Proceed. Adjusted gross income refers to your gross income minus deductions and adjustments.

For tax years beginning after. Local License Renewal Records and Online Access RequestForm 4379A Request For Information or Audit of Local Sales and Use Tax Records4379 Request For Information of State Agency License No Tax Due Online Access4379B. Pronto Tax School is an online tax school on a mission to make the lives of tax professionals easier and more profitable.

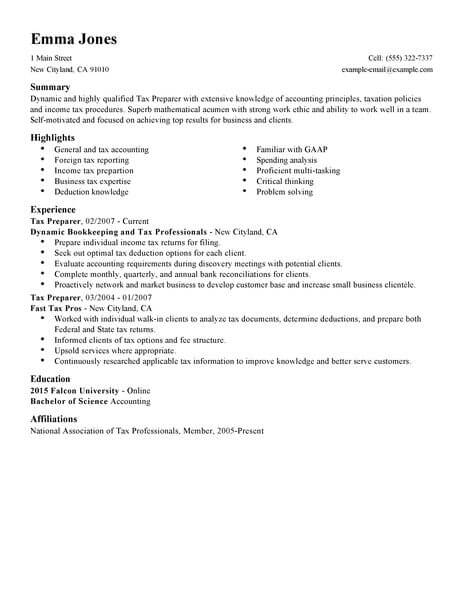

Calculating your adjusted gross income allows you to see how much of your income is taxable after these deductions have been made. On your Dashboard click e-File Income Tax Returns File Income Tax Return. A job seeker with several years of finance experience should use a combination resume format to emphasize both work history and skills in equal measure.

Tax professionals trust Pronto for regular annual online tax preparer continuing education courses. Take income tax data from a client and enter it into a computer whether in person or other contact Yes. Waiting period may apply.

Tell us about the amount subject to withholding. A background check and social mediainternet search are required for employment. They trust Pronto to provide the training.

Tell us about the amount. If a business resolves the delinquency they are removed from the list within three business days. New names are added the first week of every month.

Select Assessment Year as 2021 22 and click Continue. Seasonal Job Education. Contributions must be made by due date.

Were experiencing delays in processing paper tax returns due to limited staffing. Tax accountants manage tax obligations of companies and individuals prepare tax documentation and assist clients in taxation audits. Select Assessment Year as 2021 22 and click Continue.

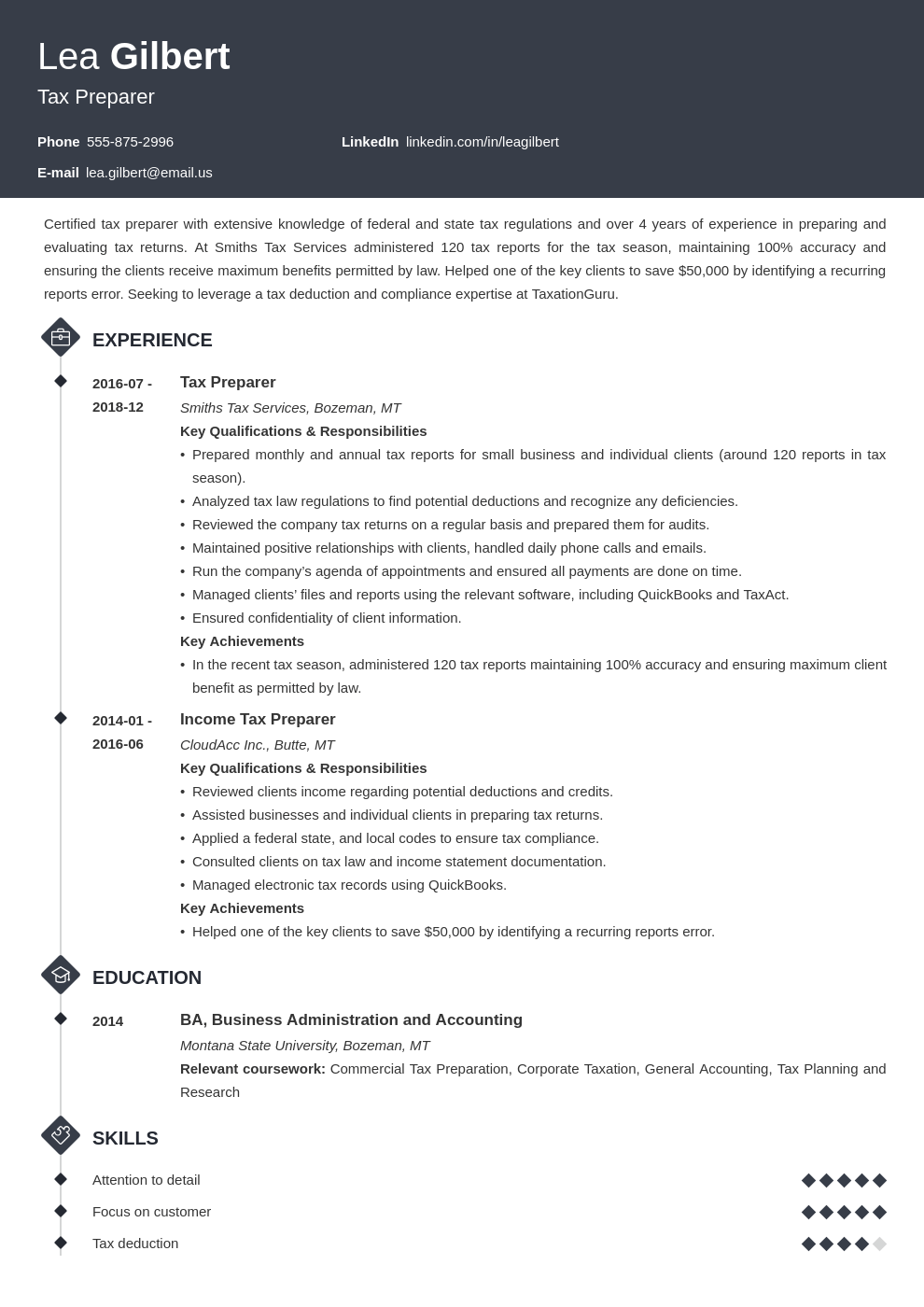

Heres how to write a tax accountant resume that proves youre a vital asset. B __ __ __ __ 2022. Work for a CTEC registered tax preparer.

Then you will be taken to the starting page of your ITR form to continue with the filing process. E -File Income Tax Returns File Income Tax Return. Once the JSON is uploaded click Proceed.

Learn About Being a Tax Preparer. Although this job seeker has only held a few positions outlining the. Your social security number and drivers license andor alien registration number if you are not a US.

Kforce Corporate Social Responsibility. Yes or you must resumebecome an active California CPA. On the other hand long-term capital gains.

The Revoked Sales Tax Permits List contains businesses with sales and use tax permits that were revoked for failing to remit the sales tax they collected. For most people this means that contributions for 2021 must be made by April 18 2022. Performed month-end reconciliations of accounting records to resolve discrepancies and ensure.

Contributions can resume for any years that you qualify. A security deposit may be required. Your federal income tax returns W-2s and other records of money earned.

Click Yes if you want to proceed. According to the Bureau of Labor Statistics as of May 2018 a Tax Preparer makes a median salary of 39390 annually. Not surprisingly compensation varies by region.

Audited and analyzed 500 credit card transactions to assist senior accountant in verifying the charge of sales tax. Review of individual income tax returns and business income tax returns. It specializes in providing relevant convenient not boring online tax courses.

Information youll need to fill out the FAFSA. Contributions can be made to your traditional IRA for a year at any time during the year or by the due date for filing your return for that year not including extensions. Select Mode of Filing as Online and click Proceed.

How much does a Tax Preparer make. Returns unless you resume withholding Illinois income tax. Your tax accountant resume needs to prove that you can deal with complex.

Local Government Tax Guide. Box 9Federal Income Tax Withheld. A Tax Preparer will receive financial documents and prepare federal income tax returns for individuals and small businesses.

Income Tax Preparer Resume Samples Qwikresume

Tax Preparer Resume Example Useful Tips Myperfectresume

Income Tax Preparer Resume Example Kickresume

Tax Preparer Resume Examples Finance Livecareer

Expert Income Tax Preparer Resume Examples Finance Livecareer

Tax Preparer Resume Example Useful Tips Myperfectresume

Tax Preparer Resume Samples Velvet Jobs